Link Aadhaar With PAN| How to Link Aadhaar With PAN Card Online Step-By-Step – As we know PAN Aadhaar Link is mandatory in India. The government of India made this rule mandatory to sync citizens’ general and financial information.

If you have yet to link your Aadhaar With your PAN, you may face problems while filling out your ITR. As per the PAN Aadhaar link news, the last date has already been passed. The deadline for PAN and Aadhar Link was 30th June 2023. If you have not linked your PAN and Aadhaar, you will now have to pay Rupees 1000 as a fine. To know the step-by-step process to link Aadhaar with PAN, read this article till the end.

Step-By-Step Process to Link Aadhaar With PAN Card Online

There are two ways you can link PAN with Aadhar:

- Link PAN with Aadhar using the Income Tax Department’s e-Filing Portal

- Link PAN with Aadhar by sending an SMS from the registered mobile number

Link Aadhaar With PAN Using the Income Tax Department’s e-Filing Portal

Using the e-Filing Portal for the PAN Aadhaar link is quick and easy. Check PAN Aadhaar link steps-by-step process given below:

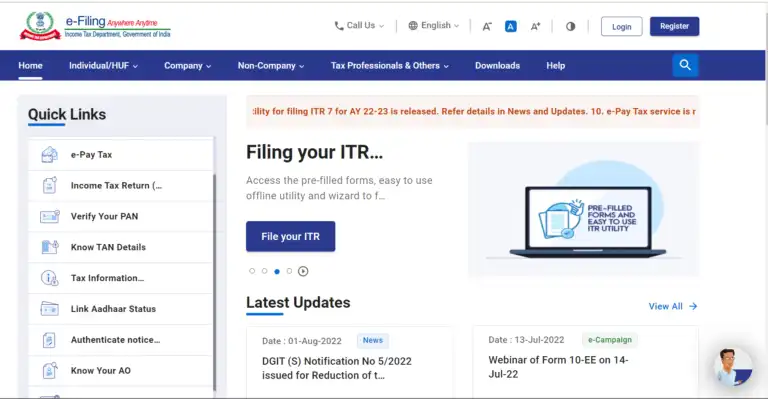

Step 1: First visit income tax e-Filing portal here.

Step 2: Now click on “Link Aadhaar” under the Quick Links section.

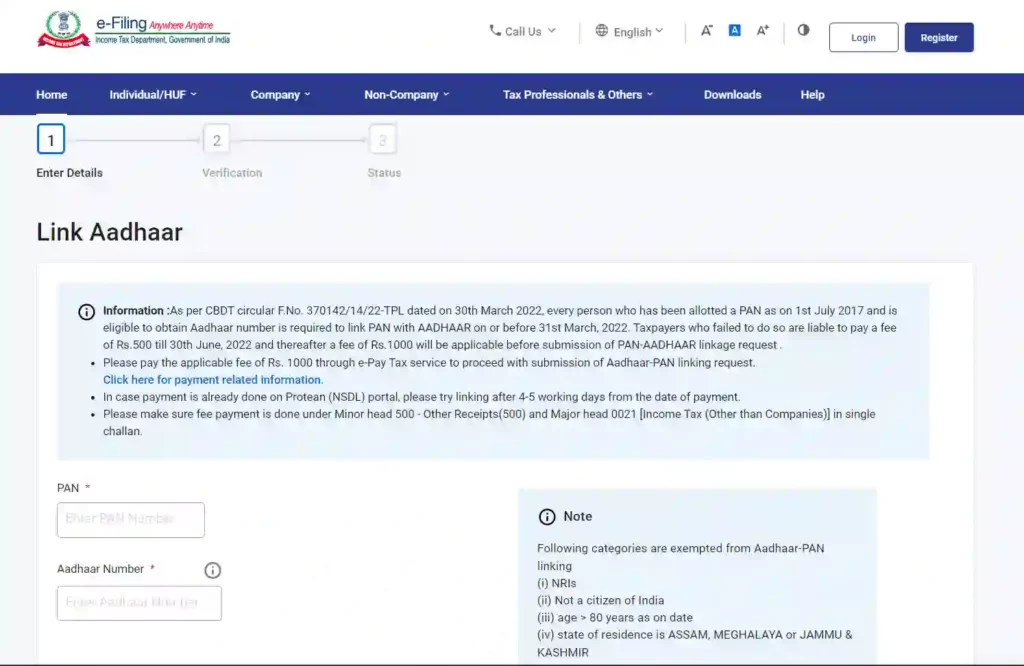

Step 3: Enter your PAN and Aadhaar number in respective columns.

Step 4: Click on the “Validate” button.

Step 5: Enter your name and registered mobile number.

Step 6: Now Click on “Verify.” You will get an OTP on your registered mobile number.

Step 7: Enter OTP and complete the verification process.

Step 8: You will get a pop-up message that your PAN and Aadhar Card are linked successfully.

Note: As the last date of PAN Aadhaar Link was 30th June 2023, now you have to pay Rupees 1000 as a penalty while requesting an Aadhaar PAN link. After payment and successfully submitting the request for PAN and Aadhaar Link, you can check its status on the same website to see whether your Aadhaar is linked with PAN or not.

Link PAN With Aadhar through SMS from the Registered Mobile Number

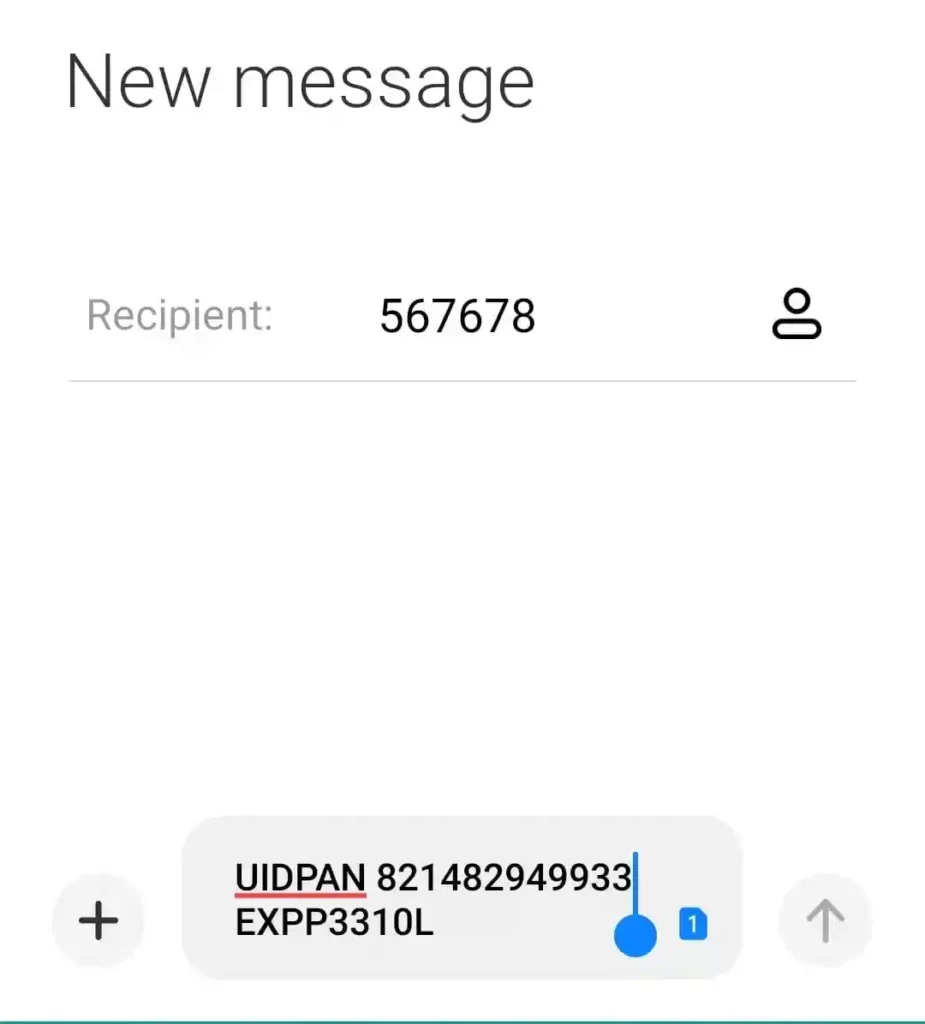

If you don’t know how to use the internet and are not able to Link PAN with Aadhar on the e-Filing Portal, you can link PAN with Aadhar by sending an SMS from your registered mobile number. Sending an SMS is also a good way for your PAN Aadhaar link status check whether you have already done it or not. Follow these steps to do so:

- Type a message in this format: UIDPAN <12-digit Aadhaar Number> <10-digit PAN number>

- Send this message either on ‘567678’ or ‘56161’ by your registered mobile number.

Link PAN With Aadhaar Now After the Deadline

As the PAN Aadhaar link last date was 30th June 2023, now you have first to pay the fees of rupees 1000. Only after that can you submit the PAN With an Aadhaar link request.

Below is the step-by-step process to pay PAN With an Aadhaar Link penalty of Rupees 1000:

- Step 1: Go to the income tax e-Filing Portal by using this link: https://www.incometax.gov.in/iec/foportal/.

- Step 2: Under the “Quick Links” section, choose the “e-Pay” Tax option.

- Step 3: Under the “PAN/TAN” column, enter your 10-digit PAN number. Enter your mobile number after confirming your PAN/TAN and click on “Continue.”

- Step 4: You will get an OTP on the registered mobile number you have entered, and after verification, you will be redirected to the e-Pay Tax page. Click on “Continue.”

- Step 5: On the e-Pay Tax page, look for the Income Tax column and click on “Proceed.”

- Step 6: Now you will see two columns: Assessment year and Type of Payment (Minor Head). Under the “Assessment Year” column, choose the option of “2024-25”, and under the “Type of Payment (Minor Head)” column, select “Other Receipts.”

- Step 7: As you will select others, the applicable amount of Rupees 1000 will be prefilled in the respective column. Click on “Continue” and make the payment.

- Step 8: Once you make the payment successfully, click on “Proceed” to link your Aadhaar with your PAN immediately.

Note: You can make the payment through debit card, NEFT/RTGS, net banking, or other payment options given on the website. You can also pay the amount through the payment gateway if you have a bank account linked with the authorized banks. The following is the list of banks approved banks; you can check if you have an account in any one of these:

- Axis Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- City Union Bank

- Federal Bank

- HDFC Bank

- ICICI Bank

- IDBI Bank

- Indian Bank

- Indian Overseas Bank

- IndusInd Bank

- Jammu & Kashmir Bank

- Karur Vysya Bank

- Kotak Mahindra Bank

- Punjab & Sind Bank

- Punjab National Bank

- RBL Bank

- South Indian Bank

- State Bank of India

- UCO Bank

- Union Bank of India

Important Links

| Link Aadhaar with PAN online | Click here |

| Check Aadhar and PAN Link Status Online | Click here |

| Check other educational article on Aadhaar | Click here |

Frequently Asked Questions

Can I link my Aadhaar and PAN for free?

Ans. No, the last date for PAN Aadhaar link was 30th June 2023. Now, everyone who wants to link Aadhaar with PAN has to pay a penalty of Rupees 1000.

How do I check if my PAN is linked with Aadhaar?

Ans. You can check it by sending an SMS from your registered mobile number. You can check the process for sending the SMS in the article.

Can I link PAN with Aadhaar offline?

Ans. No, you can not Link PAN with Aadhaar Offline.

How long does it take to link Aadhaar to PAN?

Ans. It takes 1 to 7 days to link Aadhaar to PAN.

My aadhar seems to have been linked a PAN number that is wrong, is there a way to correct the same, if yes please point me in the right direction.

Aadhaar card and pan card like