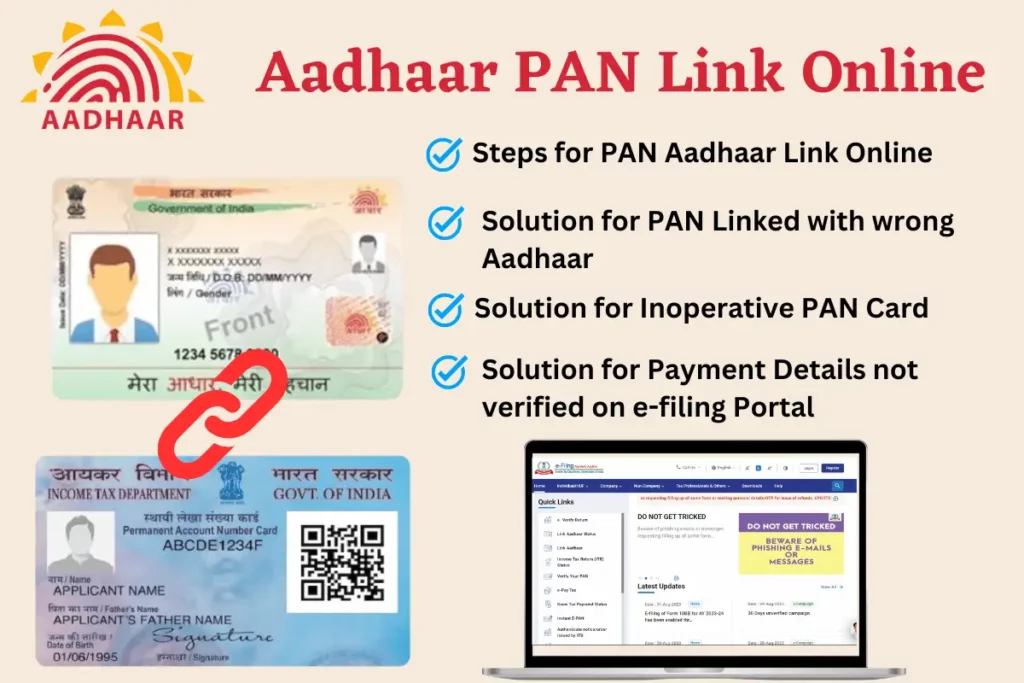

Aadhaar PAN Link | PAN Aadhaar Link Step by Step Process| How to make payment of Aadhaar PAN link fee on e-Filing Portal – As we know, Aadhaar PAN Link is mandatory in India. The Govt of India made this rule mandatory to sync a citizen’s general and financial information.

The Aadhaar Card is a Unique Identity Card provided by UIDAI to citizens of India. It consists of various information like name, DOB, Address, Iris and fingerprint scans of a citizen. Due to its security features, it is impossible to make Duplicate Aadhaar Cards. That is why the Government of India took the initiative of PAN Aadhar Link. It will also help the income tax department stop the duplicity of PAN cards.

If you do not Link your Aadhaar With your PAN, you may face problems filling your ITR. As per the CBDT circular, people who fail to link Aadhar with PAN shall face the consequences of the PAN becoming inoperative. The PAN cards of these people became inoperative on 1 July 2023. In the article, you can read all the steps of Aadhaar PAN Linking.

Fees for Aadhaar PAN Card Linking

Earlier, PAN Aadhar Link was free of cost. But when people did not take it seriously, the Government applied a penalty. Before 31 March 2023, it was free to link Aadhaar with PAN. But after that, from 1 April 2023 to 30 June 2023, a penalty of Rs. 1000 was applied for PAN Aadhar Linking.

How to make payment of the Aadhaar Pan link fee on the e-Filing Portal

Taxpayers who do not link Aadhar with PAN before the announced last date have to pay a certain penalty for Aadhaar PAN Link Online. If you are a taxpayer in India and want to know the process of PAN Aadhar Link Fee Payment process, then follow these steps:

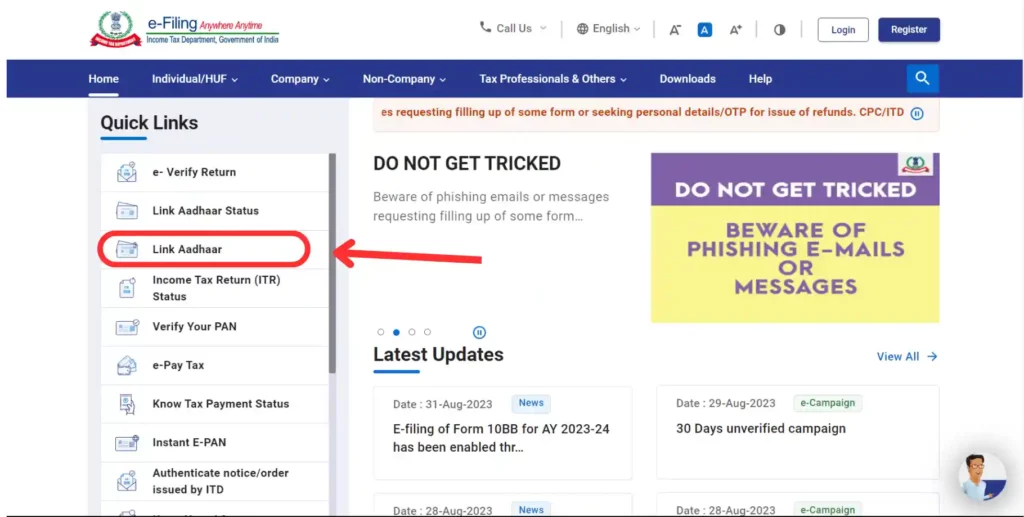

Step 1: Visit the e-filing Portal of the Income Tax Department, i.e. https://www.incometax.gov.in/iec/foportal/

Step 2: Click the “Link Aadhaar” button from the ‘Quick Links’ Section.

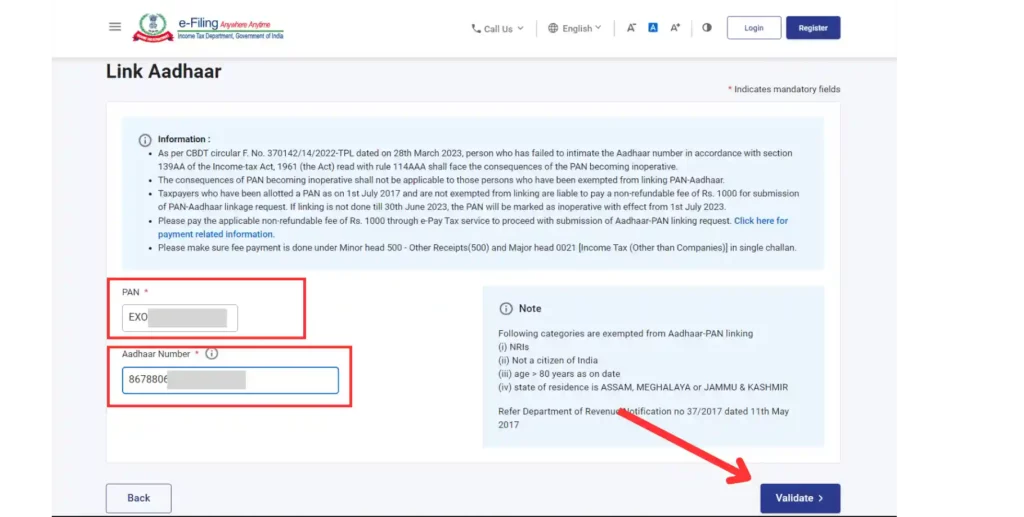

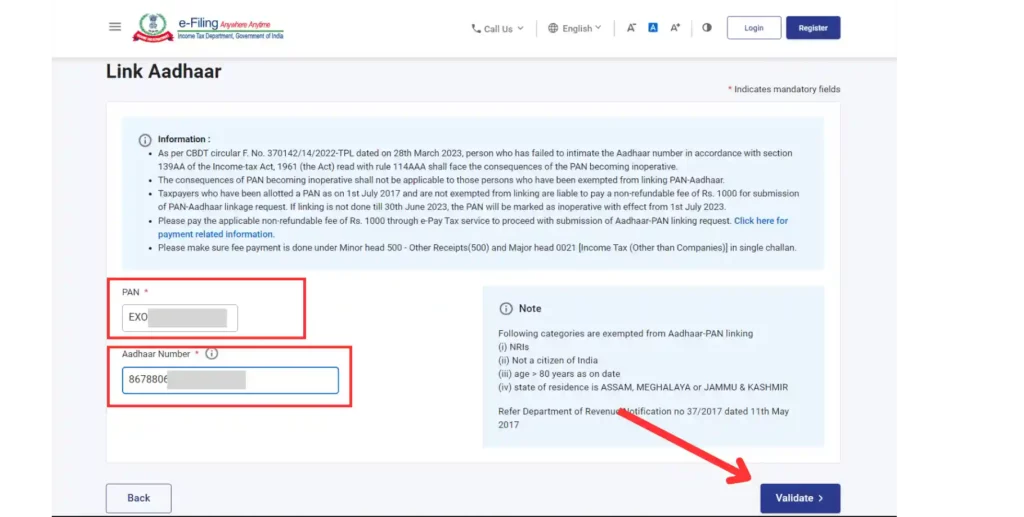

Step 3: Enter your PAN and Aadhaar Number on the next page.

Step 4: Now click the Validate button to submit an Aadhaar PAN Link request.

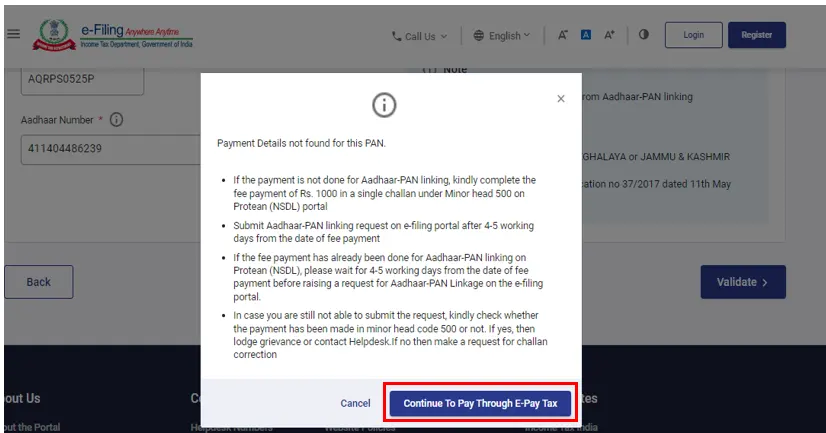

Step 5: After that, it will show a Pop-up with a Link to “Continue to Pay Through E-Pay Tax.”

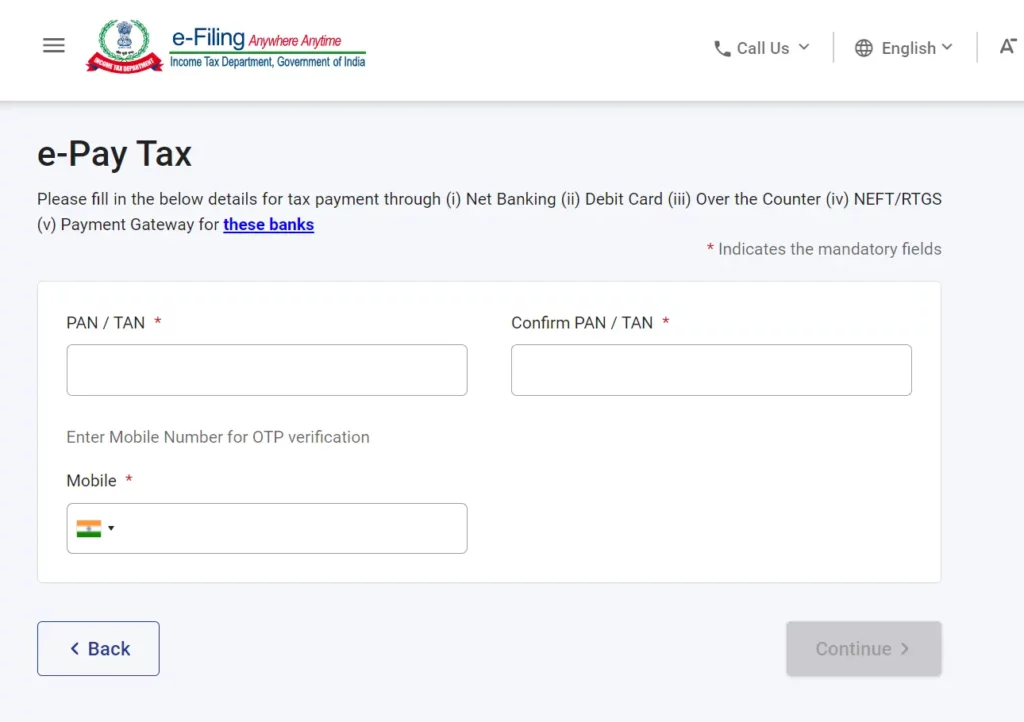

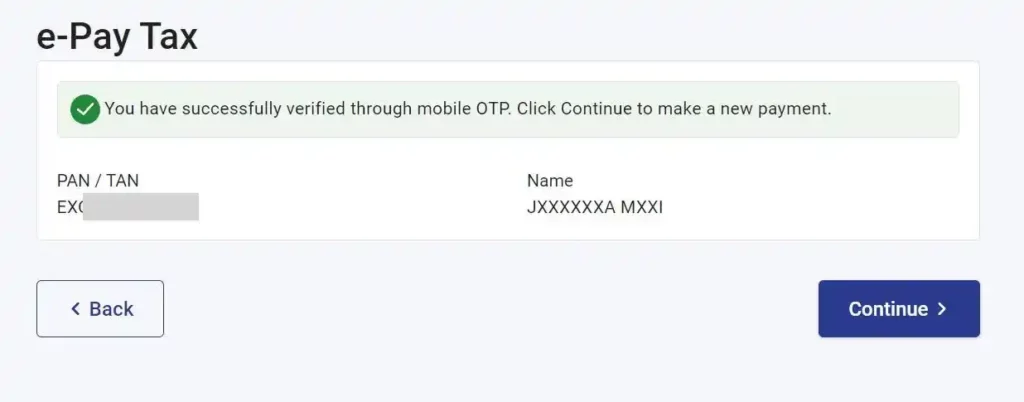

Step 6: It will take you to the e-Pay Tax page. Here, you will have to enter Your PAN/TAN number twice. And Enter any mobile number for OTP verification.

Step 7: Click the “Continue” button and enter OTP for verification.

Step 8: After OTP verification, you will be redirected to the e-Pay Tax Payment page.

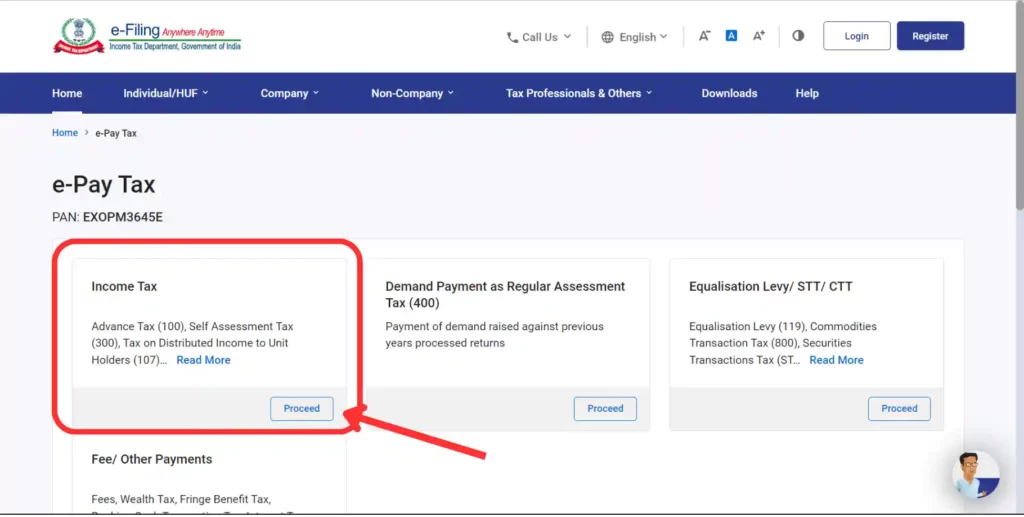

Step 9: Click the “Proceed” button on the Income Tax section.

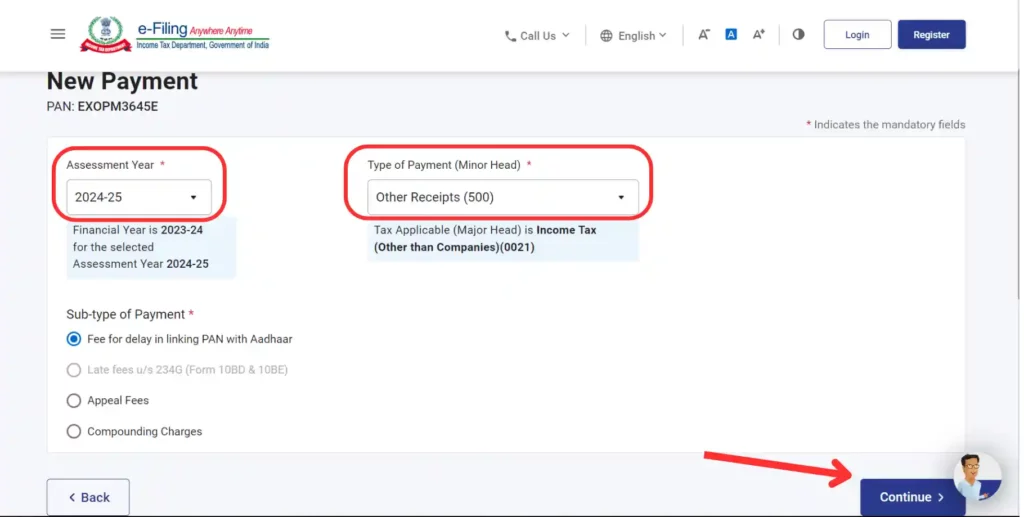

Step 10: On the next page, in ‘Assessment Year’, select Relevant Year, and in ‘Type of Payment’, select Other Receipts (500) and click the Continue button.

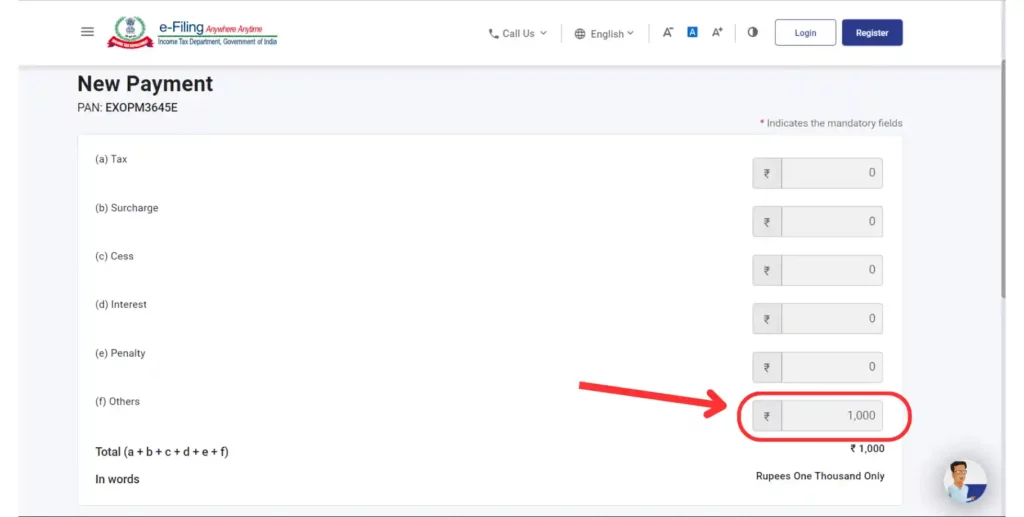

Step 11: The applicable amount will be pre-filled against Others. Click the “Continue” button.

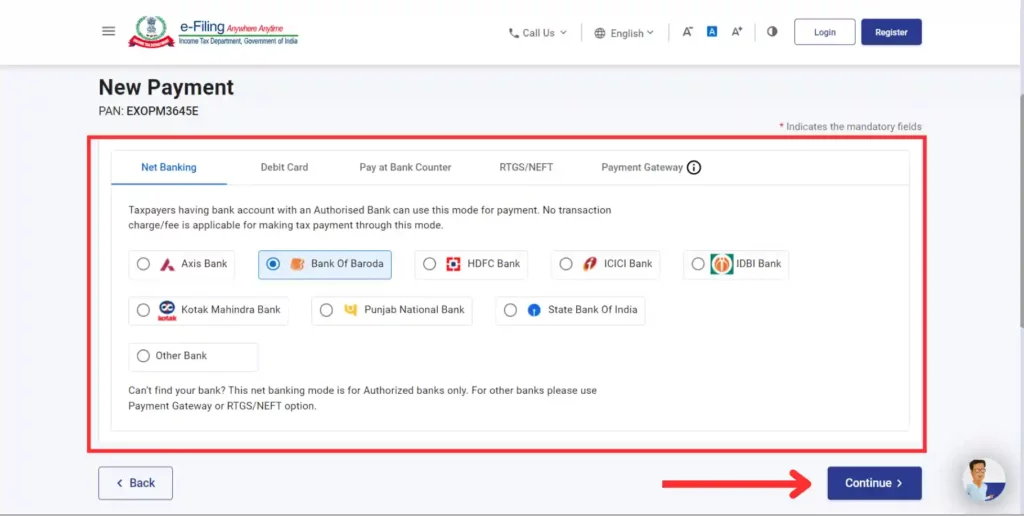

Step 12: Now, it will generate Challan. On the next page, you must choose the Payment method (Bank, Net Banking, Debit Card, etc.).

Step 13: Click the “Continue” Button to complete the payment via your bank website.

Note:- After payment of PAN Aadhar Link Fees, wait 10 to 20 minutes. Then, you can go ahead with the Aadhaar PAN Link.

Aadhaar PAN Link: Step-by-Step Process

Taxpayers who missed the last PAN Aadhar Link must pay the penalty fee. To pay Aadhaar PAN Link Penalty fees, you can follow the process in the above section. There are two ways by which you can Link Aadhar To PAN card. Following are the two easy ways to Link Aadhaar with PAN:

- PAN Aadhar Link using the Income Tax Department’s e-Filing Portal.

- PAN Aadhar Link by sending an SMS from the registered mobile number.

Aadhaar PAN Link Methods via e-Filing Portal

Process for PAN Aadhar Link (Pre-Login)

It is very easy to link Aadhar with PAN using the e-filing Portal of the Income Tax Department. Follow these steps to Link PAN with Aadhar:

Step 1: First, visit the income tax e-filing portal here

Step 2: Now click on “Link Aadhaar” under the Quick Links section

Step 3: After that, enter your PAN and Aadhaar number

Step 4: Click on the ‘Validate‘ button

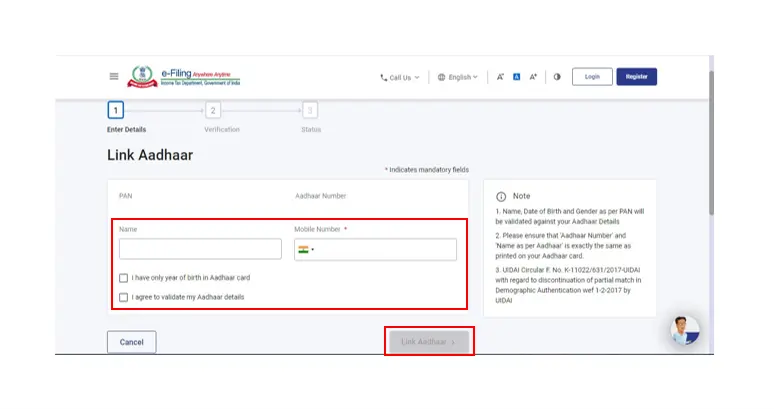

Step 5: After that, Enter your name and registered mobile number.

Step 6: Now Click on Verify. You will get an OTP on the registered mobile number

Step 7: Enter OTP and click the “Validate button,

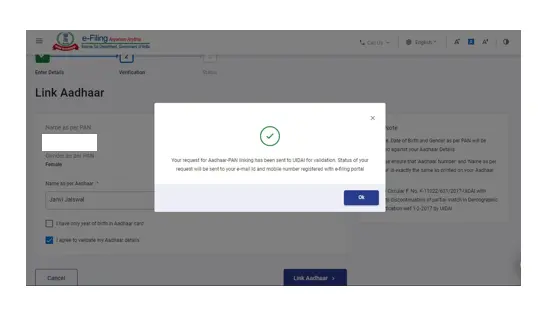

Step 8: You will get a Pop-up message: “Your request for Aadhaar-PAN linking has been sent to UIDAI for validation.”

Note: In this way, you can link Aadhaar to PAN using the Income Tax e-filing portal. After successfully submitting the request for PAN And Aadhaar Link, you can check the Aadhaar PAN link status to see whether your Aadhaar is linked with PAN.

Process for PAN Aadhar Link (Post Login)

Taxpayers can also Link Aadhar to PAN after logging in to the e-filing Portal. Here is the step-by-step process for this:

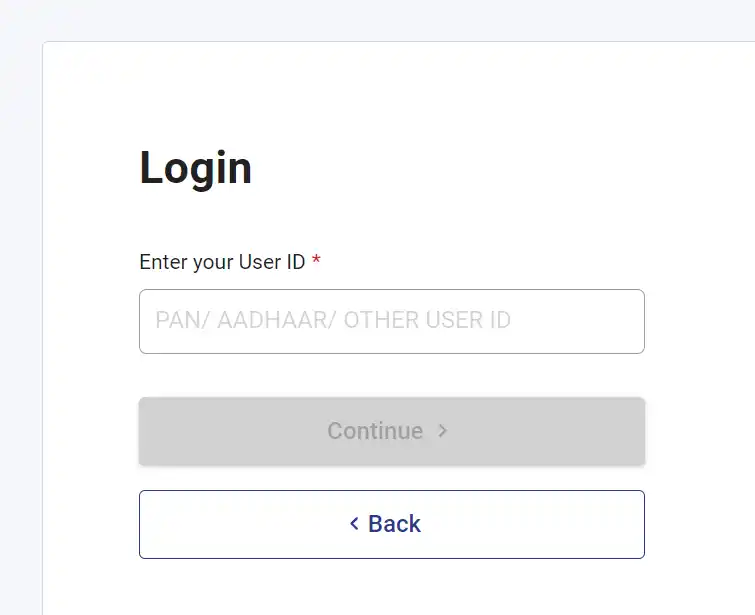

Step 1: Visit the e-filing Portal and click the “Login” button

Step 2: Now login with your PAN

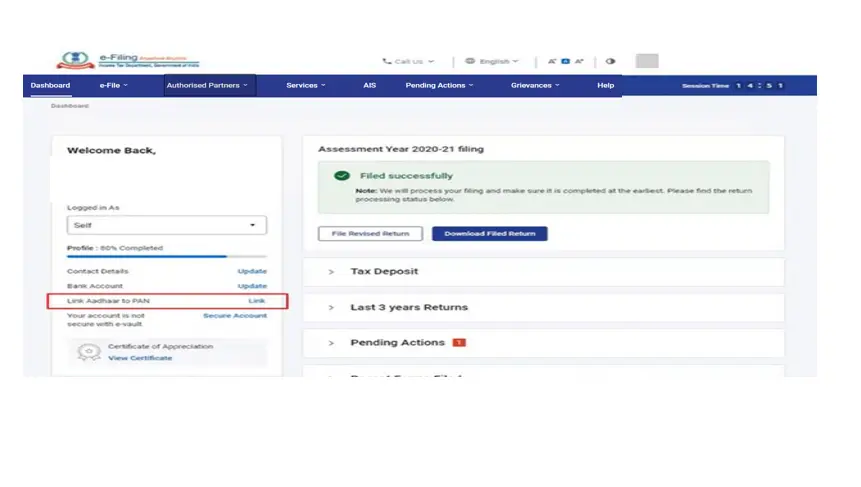

Step 3: On your Dashboard, Click the “Link Aadhaar” option under the ‘Link Aadhaar to PAN’ section.

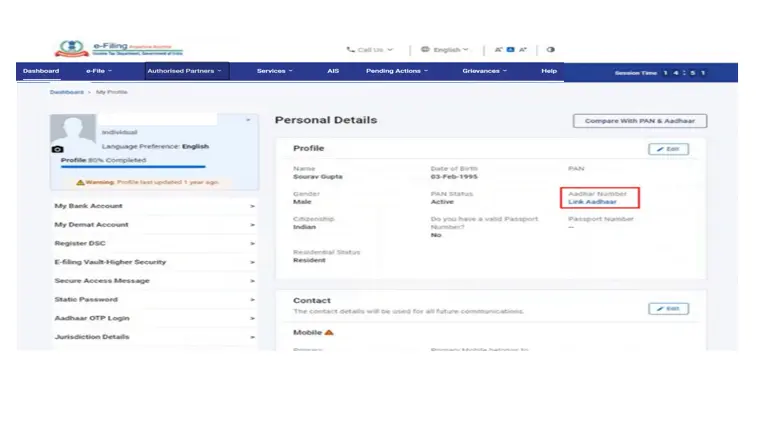

Step 4: Alternatively, you can also go to the personal details section to perform the above task.

Step 5: Now enter Your Aadhaar Number and click the “Validate” button to Submit an Aadhaar PAN Link request.

Situations You may face while Linking Aadhaar PAN Online

Sometimes Linking your PAN with Aadhaar will not be easy. Taxpayers face some issues while linking PAN and Aadhaar. I have shared these 3 situations and their solutions:

Situations 1: Payment Details not verified on e-filing Portal

If you did not pay the Penalty fee for the Aadhaar PAN Link, then it is a prerequisite to pay penalty fees. If you paid PAN Card Aadhar link penalty fees, but it still shows the above message, wait 3-4 working days. After that, you can submit a PAN Aadhar Link request.

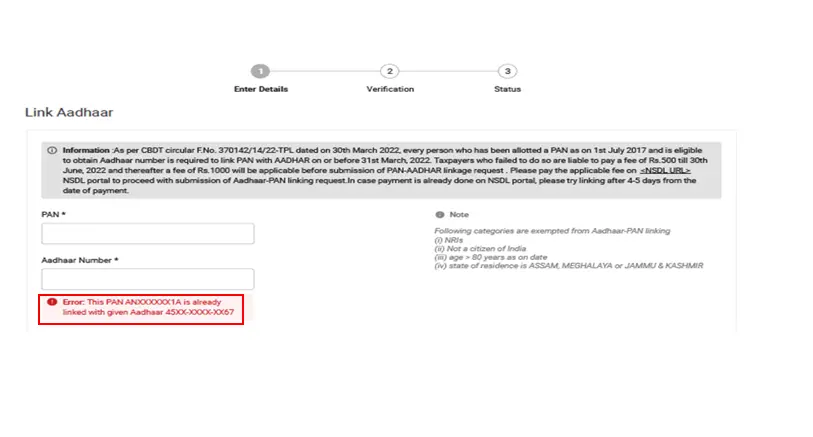

Situations 2: PAN is already linked with the Aadhaar or with some other Aadhaar

In case your PAN and Aadhaar are already linked, or your Aadhaar is linked with another PAN or vice versa, you will get the following error:

But you may need to contact your Jurisdictional Assessing Officer if your PAN is linked with the wrong Aadhaar number. You can submit a request for delinking your Aadhaar with an incorrect PAN.

Situation 3: If you have made payment of Challan and payments and details are verified at e-filing Portal.

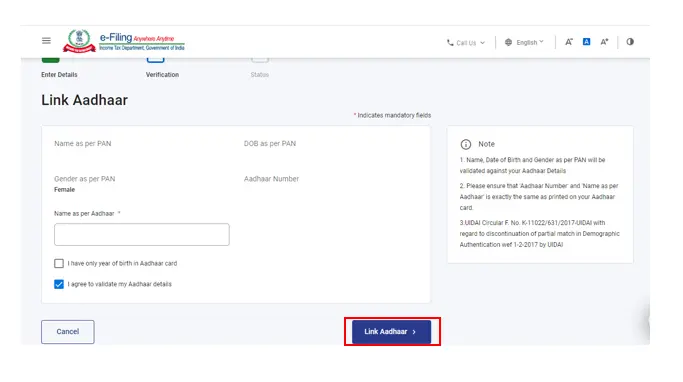

Step 1: After completing validation Process of PAN and Aadhaar you will see a popup on your screen that “Your payment details are verified”. Click the ‘Continue’ button.

Step 2: Now, enter all the required information as per your Aadhaar Card. And click the “Link Aadhaar” button.

Step 3: Your request for PAN Aadhaar Link has been submitted, now you can check Aadhaar PAN Link Status Online.

Link PAN with Aadhar by sending an SMS from the registered mobile number

If you don’t know how to use the internet and are not able to Link PAN with Aadhar on the e-filing Portal. In this case, you can Link PAN with Aadhar by sending an SMS. Follow these steps to do so:

- Type a message in the following format:

- UIDPAN<12 Digit Aadhaar Number> <10 Digit PAN number>

- Send this message to 567678 or 56161 by your registered mobile number.

Last Date to Link Aadhaar With PAN

The last Date to Link Aadhaar with PAN has been extended. Now, you can link your PAN with Aadhar till 30 June 2023. Earlier, it was 31 March 2023, but Govt of India extended this deadline to Link Aadhaar with PAN.

New Update: The last Date for the Aadhaar PAN link has been ended. The PAN card of taxpayers who did not perform the PAN Aadhar Link task became inoperative from 1 July 2023.

Who should link Aadhar to PAN card?

Many people are confused because they don’t know for whom this Aadhaar PAN Link is mandatory. So, according to a circular released by the Central Board of Direct Taxes, the Aadhaar PAN Link is mandatory for those Taxpayers who have been allotted a PAN as of 1 July 2017 and are not exempted from linking PAN Aadhar.

It means PAN card Aadhar link is mandatory for those taxpayers who got their PAN card before 1 July 2017. Those who got their PAN Card on or after 1 July 2017 don’t need to link their Aadhar card to their PAN.

Useful Links

| Link Aadhaar with PAN online |

| Check Aadhar and PAN Link Status Online |

| Read other educational articles on Aadhaar |

Frequently Asked Questions

Q 1. How can I link Aadhar with a PAN card?

Ans. To link Aadhar with PAN, visit www.incometax.gov.in, or you can also send an SMS UIDPAN<12 Digit Aadhaar Number> <10 Digit PAN number> on 567678 or 56161 by your registered mobile number.

Q 2. Can we link Aadhar to PAN in Mobile?

Ans. Yes, you can link Aadhar to PAN in Mobile by using the SMS method or by visiting the Income Tax e-Filing Portal.

Q 3. Can I link PAN with Aadhaar offline?

Ans. No, you can not Link PAN with Aadhaar Offline.

Q 4. What happens if PAN and Aadhaar are not linked?

Ans. If PAN and Aadhaar are not linked, the PAN card becomes inoperative from 1 July 2023.

Q 5. What is PAN Aadhar Link penalty fees?

Ans. From 31 March to 30 June, the Aadhaar PAN Link penalty fee is Rs. 1000.

Q 6. How to pay PAN Aadhaar linking fees?

Ans. To pay PAN Aadhaar linking fees, visit the e-filing Portal and then the e-Pay Tax page. After that, choose Other Receipts (500), and the default penalty will be reflected in the form. Choose a payment method and Complete the penalty fee payment.

Q 7. What is the penalty for PAN Aadhaar link after 31 July 2023?

Ans. If someone missed the final deadline of PAN Aadhar Link after 31 July 2023, they will have to pay a higher penalty of Rs. 5000 (if the entire revenue surpasses Rs. 5 lakh).

Q 8. How long does it take to link Aadhaar to PAN?

Ans. It takes 1 to 7 days to Link Aadhaar to PAN.